For Most Investors Bitcoin and other Cryptocurrencies are Unsuitable Investments

Get Your Free Consultation

Practice Areas

Recent Posts

Have you suffered significant financial harm due to the purchase of a premium-financed universal life insurance policy?

Have you suffered significant financial harm due to the purchase of a premium-financed universal life insurance policy? Some life insurance policies, in addition to providing financial compensation upon the insured's death, accumulate cash value over time. This cash...

read moreBitcoin, Ethereum, Ripple, Litecoin, Dash, NEM, Cardano, Stellar, IOTA, EOS, Monero, Qtum and Zcash are just a few of the Cryptocurrencies making investment news lately. However, Cryptocurrencies generally are not regulated by any government entity and are more than likely overvalued (possibly worthless) making them the literal definition of a speculative investment and unsuitable for the majority of investors. If your broker / financial advisor recommended that you invest in Bitcoin or other Cryptocurrencies and you lost money as a result, the attorneys at Epperson & Greenidge may be able to sue to recover your losses.

FINRA has issued the following alert to investors about Bitcoin and other Cryptocurrencies:

Don’t Fall for Cryptocurrency-Related Stock Scams

Cryptocurrencies (such as Bitcoin) are in the news daily. FINRA is issuing this Alert to warn investors to be cautious when considering the purchase of shares of companies that tout the potential of high returns associated with cryptocurrency-related activities without the business fundamentals and transparent financial reporting to back up such claims.

Do your research before purchasing shares of any company offering investment opportunities in cryptocurrency. And don’t be fooled by unrealistic predictions of returns and claims made through press releases, spam email, telemarketing calls or posted online or in social media threads. These actions may be signs of a classic “pump and dump” fraud.

The SEC suspended trading in a number of securities due to questions regarding the accuracy of cryptocurrency-related activities. For example, trading was suspended when the SEC questioned the accuracy of claims regarding:

- the liquidity and value of a company’s assets in DIBCOINS, a cryptocurrency;

- assertions by several companies that each planned to conduct an Initial Coin Offering (ICO); and

- a company’s claimed transition from a vape products business to one involved in cryptocurrency and adoption of blockchain technology.

Tips to Avoid a Cryptocurrency-Related Stock Scam

Especially in today’s “hot” cryptocurrency environment, it’s easy for companies or their promoters to make glorified claims about new products, services and other cryptocurrency-related connections. And, even when legitimate companies flock to a hot, new sector, fraudsters almost always follow suit, exploiting the news to launch their latest frauds du jour. Follow these tips to avoid costly mistakes.

- Do not say “yes” to cryptocurrency stock purchases from an aggressive cold caller, even if the claims sound plausible, particularly if the recommended stocks are very low-priced. Don’t feel guilty about hanging up. Not answering at all, or putting down the phone, are generally the best and safest responses to a cold caller or anyone aggressively pitching low-priced stocks or other investment opportunities.

- Be suspect of anyone who makes guarantees that an investment will perform a certain way, or makes pushy sales pitches that encourage you to “act now.”

- Use FINRA BrokerCheck® to the check registration status of, and additional information about, the people and firms who tout these opportunities.

- Check the SEC’s EDGAR database to find out whether the company files with the SEC. If so, read the reports and verify any information you have heard about the company. But remember, the fact that a company that has registered its securities or filed reports with the SEC doesn’t mean that the company will be a good investment.

- Be wary of stocks with huge spikes in price: this could signal potential manipulation or fraud.

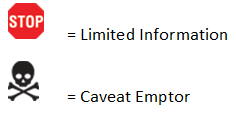

- Know where the stock trades and pay attention to any cautions associated with the stock. Most stock pump-and-dump schemes tend to be quoted on an over-the-counter (OTC) quotation platform like the OTC Markets, which provides icons to warn investors of concerns associated with a given company. These include a stop sign to indicate the company cannot or will not provide important information to regulators, exchanges or the OTC Markets—and also a skull and crossbones to warn that the security, company or a person who controls the company might be involved in a spam campaign, questionable marketing, regulatory action or more.

Delaware County Unsuitable Investments Attorney

If you or someone you know has lost money due to a broker / financial advisor’s recommendation to trade in Bitcoin or other Cryptocurrencies, call the experienced attorneys at Epperson & Greenidge at 877-445-9261 for a free consultation. You may be eligible to recoup your losses. Epperson & Greenidge accepts all cases on a contingency basis; we only get paid if and when you collect money. Time to file your claim may be limited, so we encourage you to avoid delay. Call 877-445-9261 now to speak to an attorney for free.